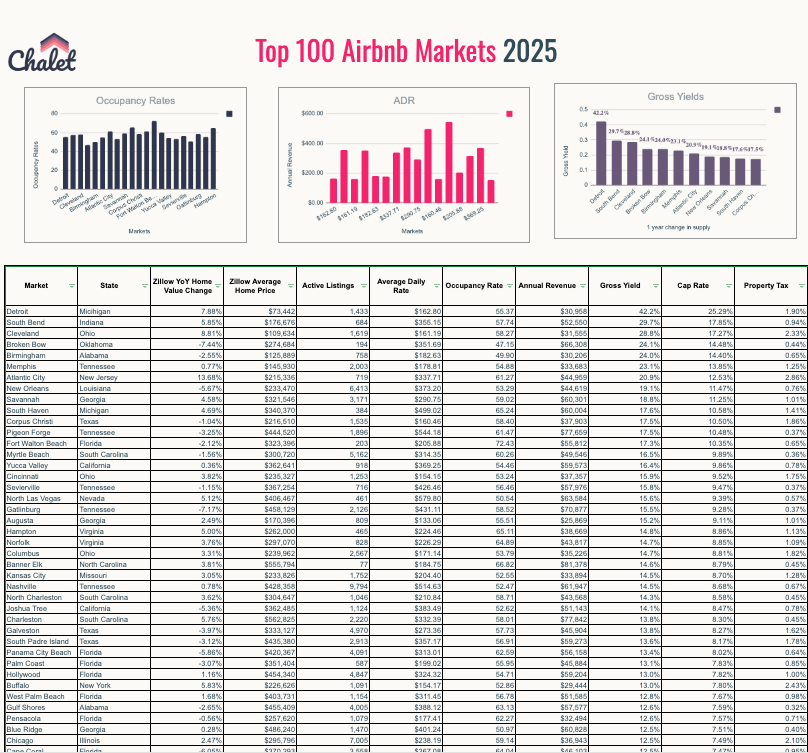

Comprehensive FAQs for Short-Term Rental (STR) Regulations in Gatlinburg, TN

Investing in short-term rental (STR) properties requires an in-depth understanding of local regulations. Below is a comprehensive list of frequently asked questions (FAQs) for Airbnb operators and investors to help you navigate the rules in Gatlinburg, TN and stay compliant while maximizing profitability.

1. What is considered a short-term rental in Gatlinburg, TN?

Any lodging offered for transient occupancy of fewer than 30 consecutive days within the city limits is classified as an “overnight rental” and requires a Tourist Residency Permit. (Overnight Rental Information).

2. Do I need a permit to operate a short-term rental in Gatlinburg, TN?

Yes. You must obtain:

- A City of Gatlinburg Business License ($15 application fee) and a Sevier County Business License ($15 application fee) (Overnight Rental Information).

- A Tennessee Department of Revenue tax ID (required for gross receipts and sales taxes).

- A Tourist Residency Permit, which carries a $200 fee for a two-bedroom (or fewer) unit plus $75 per additional bedroom; permit fees cover the required fire and building inspections (Apply for a Tourist Residency Permit).

3. What are the zoning laws for STRs in Gatlinburg, TN?

Before applying for a Tourist Residency Permit, you must confirm with the Building & Planning Department that your property’s zoning classification allows overnight rentals. Contact the Department at (865) 436-7792 or visit City Hall, 2nd floor, for zoning verification (Apply for a Tourist Residency Permit).

4. Are there occupancy limits for short-term rentals in Gatlinburg, TN?

You declare the maximum occupant count on your Tourist Residency Permit application. Properties over three stories, exceeding 5,000 sq ft, or accommodating more than 12 guests must install an approved sprinkler system before permit issuance (TR Permit Application).

5. What taxes are short-term rental hosts required to pay in Gatlinburg, TN?

- Gross Receipts Tax: 1.25 % of total gross sales, due monthly by the 20th (Overnight Rental Information).

- Hotel/Motel Tax: 3 % city tax (plus the state’s 9.75 %, totaling 12.75 %), remitted monthly by the 20th (Overnight Rental Information).

- State & Local Sales/Occupancy Taxes: Platforms like Airbnb collect and remit Tennessee state sales tax (7 %), local sales tax (1.50–2.75 %), and any local occupancy taxes on hosts’ behalf (Airbnb Help Center).

Under Tennessee’s updated occupancy tax rule (effective July 1st, 2025), the first 30 days of any rental stay are subject to local occupancy tax, even if the reservation exceeds 30 days in total. This means also regardless of whether the booking becomes a mid-term rental (31+ days).

6. What are the safety and health requirements for STR properties in Gatlinburg, TN?

All Tourist Residency Permit applications include fees for mandatory fire and building inspections. Properties subject to sprinkler requirements must demonstrate compliance prior to permit approval (Apply for a Tourist Residency Permit).

7. How are noise and nuisance complaints handled in Gatlinburg, TN?

The City’s general code-enforcement process applies; STR-specific procedures are not outlined in Gatlinburg’s ordinance. Best practice is to establish a clear guest conduct policy and respond promptly to any neighborhood complaints.